1099-G/1099-INTs are now available

To look up your Form 1099-G/1099-INT online, you’ll need the following information from your most recently filed Virginia tax return:

- Your adjusted gross income (Line 1)

- If you filed a part-year return, add together the amounts from both columns, Line 1.

- The tax year of your return

- Your Social Security number (If you filed jointly, you’ll also need your spouse’s SSN).

Please note: This 1099-G does not include any information on unemployment benefits received last year. If you're looking for your unemployment information, please visit the VEC's website.

Questions? Call Customer Service at 804.367.8031.

Get Your Form 1099-G Now

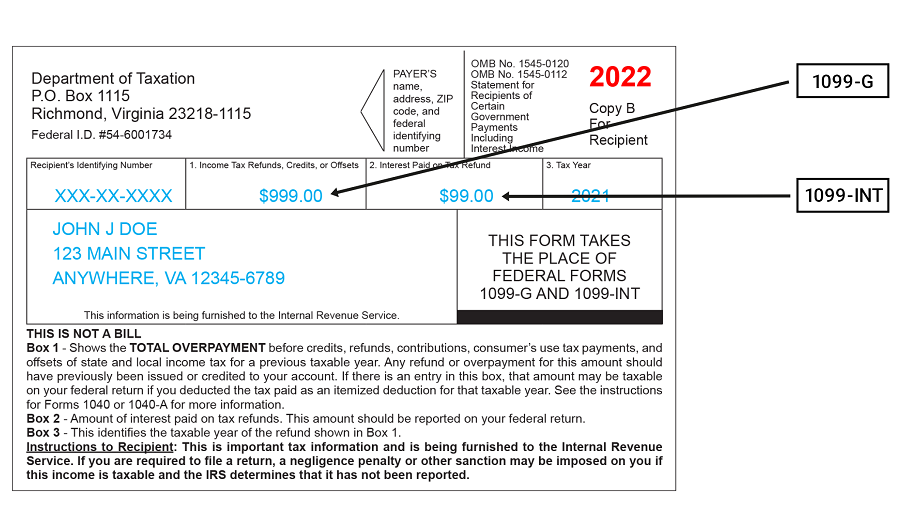

Understanding your Form 1099-G/1099-INT

Your Form 1099-G reflects any refund or overpayment credit you received from us last year (Box 1), and any corresponding interest (Box 2). This year, it will also include the amount of your one-time tax rebate (if you received one from us, and itemized deductions last year). If you itemized deductions last year, you may need to report these amounts as income on your federal income tax return.

For more information about whether to report the one-time tax rebate as income on your federal return, please review the February 10, 2023 IRS Guidance, and consult a tax professional if you have additional questions.  Visit Form 1099-G/1099-INT for more information.

Visit Form 1099-G/1099-INT for more information.