Check your refund status

Use our Where’s my Refund tool or call 804.367.2486 for our automated refund system.

Both options are available 24 hours a day, 7 days a week, and have the same information as our customer service representatives, without the wait of the phone queue.

- How long will it take to get your refund?

- What can slow down your refund?

- Why did we make a change to your refund?

How long will it take to get your refund?

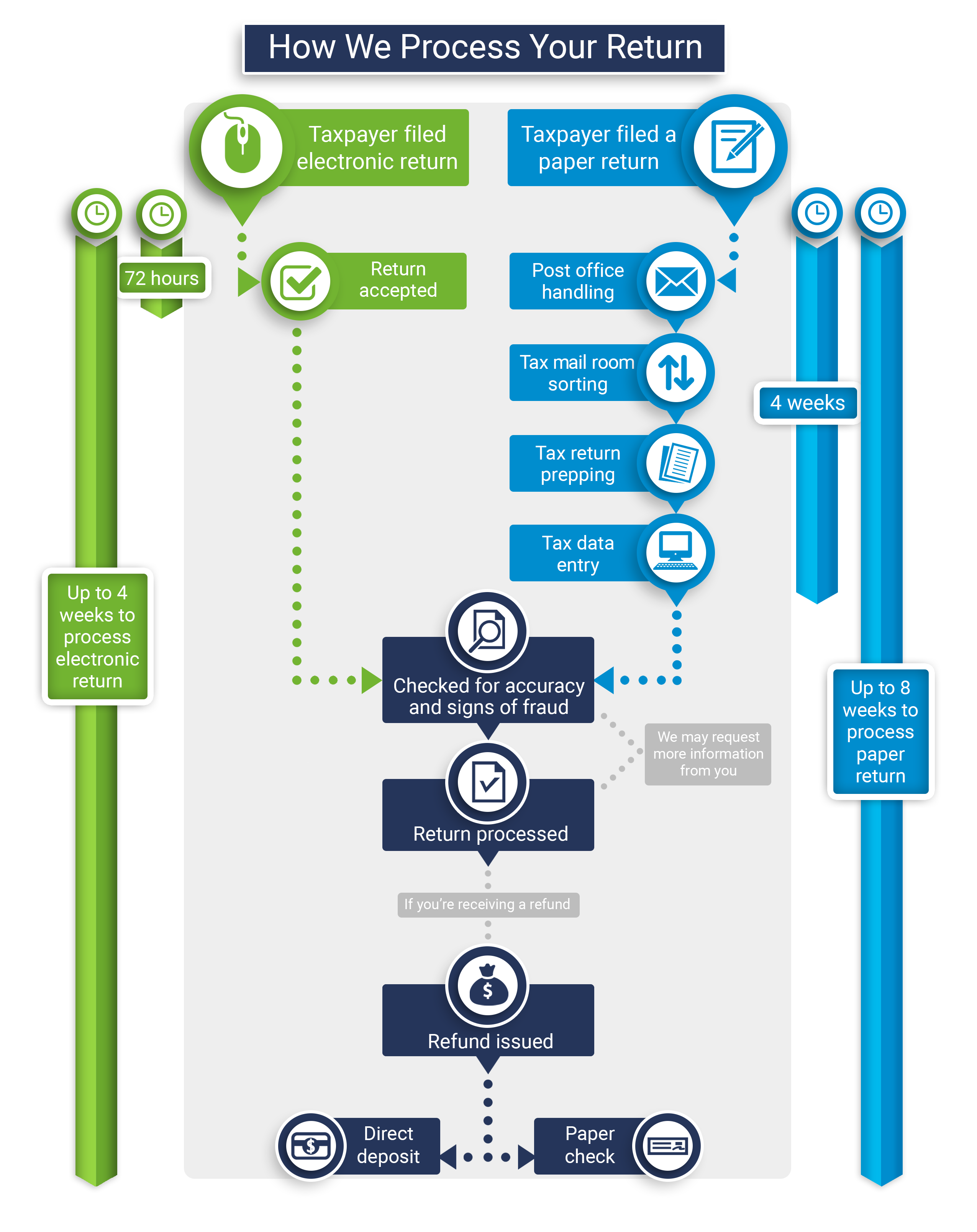

General refund processing times during filing season:

- Electronically filed returns: Up to 4 weeks

- Paper filed returns: Up to 8 weeks

- Returns sent by certified mail: Allow an additional 3 weeks

Processing times will vary based on individual factors. See What Can Slow Down Your Refund? for more information.

The Where’s my Refund application shows where in the process your refund is. When we've finished processing your return, the application will show you the date your refund was sent.

What can slow down your refund?

We have some questions about your return

- Your return was selected for additional review. Because of the continuing threat of identity theft, we sometimes need to look at a return a little closer to make sure that we send your refund to the right person. If this happens, we may need to ask you for more information. Learn more about our refund review process and what we're doing to protect taxpayers.

- Your return was missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. If we need to correct your return, we will send you a letter detailing the changes we made.

We made a change to your refund

- You owe money to a local, state, or federal agency. We are required by law to use your refund to help pay off that debt. We’ll send the remainder of your refund out to you as soon as possible, but the process can take time. For more information about the debt setoff process, see Why was your refund reduced or withheld (offset)?

- Your refund was mailed to you as a paper check. If there are changes to your refund amount, either because we adjusted your return or because you owed money to an outside agency, then we are required to send your updated refund as a paper check in the mail.

There was a problem with your bank information

- If you entered any of your bank information incorrectly, your bank won't be able to process the deposit and we will have to send your refund as a check. Depending on how soon your bank notifies us, this may take an additional 2 weeks.

Paper returns take longer to process

- You filed on paper. The fastest way to get a tax refund is by filing electronically and choosing direct deposit. Paper processing takes significantly longer than electronic processing. And due to post office processes, returns sent to us by certified mail can take even longer.

Why is your refund different than you expected?

Errors or missing information

If your tax return had one or more errors, we may need to adjust your return leading to a different refund amount than you claimed on your return. We will send you a letter explaining the adjustments we made and how they affected your refund. If you have questions about the change, please call Customer Services.

Tax refund offsets - applying all or part of your refund toward eligible debts

- If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills and how much of your refund was applied. If you have questions or think the refund was reduced in error, please contact us.

- If you owe money to Virginia local governments, courts, other state agencies, the IRS, or certain federal government agencies we will withhold all or part of your refund to help pay these debts. We will send you a letter with the name and contact information of the agency making the claim, and the amount of your refund applied to the debt. We do not have any information about these debts. If you think a claim was made in error or have any questions about the debt your refund was applied to, you'll need call the agency that made the claim.

If you have a remaining refund balance after your debts are paid, we will send a check to the address on your most recent tax return. We cannot issue reduced refunds by direct deposit.

For more details about state and federal offset programs, see Why Was Your Refund Reduced or Withheld (Offset)?

Why did you receive a check when you requested direct deposit?

You will receive a check if:

- Your refund was reduced because we withheld part of your refund to pay authorized debts as explained above.

- We adjusted your refund amount. We will send you a letter explaining why the refund was adjusted.

- Your bank account information was incorrect or the bank account was closed.

- You provided a routing number for a bank located outside the territorial jurisdiction of the United States. Due to electronic banking rules, we cannot make direct deposits to or through international financial institutions.